Presidential candidate Mitt Romney released his tax returns, and the news channels were abuzz with commentary about his effective federal tax rate of 13.9% on $21.7M of income. I will refrain from my own commentary on his situation, but what particularly piqued my interest were the quotes I heard from “ordinary” people on the radio. Everyone, it seems, claims to pay a higher federal tax rate than Mr. Romney. Typical was a person interviewed in a news report who stated “I pay 28% in taxes and have trouble every month making my rent.”

Listening to people comment on their own tax rates left me with two impressions. I couldn’t help but feel that most, if not all, of the people I heard were severely overestimating their own effective federal tax rates, and I suspected that most people did not understand the difference between effective tax rate and marginal tax rate. I also saw an opportunity to fire up Analytica to explore the relationship between the two concepts.

Before proceeding, I should disclaim that I am not an accountant or lawyer, or in any way certified to give tax advice. Nothing I am discussing here should be construed as tax advice. Yada yada yada.

Your effective tax rate is simply the amount of tax you pay divided by your total income. Your marginal tax rate in percent is equal to the number of cents that your tax liability would decrease if your income decreased by one dollar. The term tax bracket identifies your marginal rate. If you are like most people who derive the bulk of their income from wages and earned income, the progressive structure of the US income tax rate results in your marginal tax rate being higher than your effective tax rate.

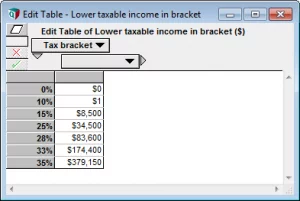

To explore these concepts, I created an index named Tax_bracket and an edit table titled “Lower taxable income in bracket” (with identifier Lower_taxable_income), and populated the edit table with 2011 income thresholds for a single filer:

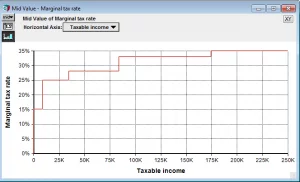

For an arbitrary Taxable_income, the following Analytica expression looks up the applicable marginal tax rate from the table:

StepInterp(Lower_taxable_income,Tax_bracket,Taxable_income,Tax_bracket)

By defining Taxable_income as Sequence(0,$250K), we obtain a graph of marginal tax rates as a function of taxable income:

To arrive at taxable income, you need to subtract your deductions from your net income and make numerous other adjustments that embody the complexity of the US tax code. The average person with $100K of taxable income has a total income of around $125K.

Now, how do you go from here to effective tax rate? This requires two steps. First, you need to compute your tax liability (i.e., taxes paid), and then you need to divide by total income (rather than just by taxable income). Given a particular taxable income, the tax liability is the area under the above curve falling to the left of your taxable income. With Taxable_income defined as a sequence, we can compute income Tax_liability using:

Integrate(Marginal_tax_rate,Taxable_income)

I will ignore other non-earned sources of income (e.g., capital gains income) for simplicity, which would have to be added to this as well. The second piece, relating total income and taxable income, is far more involved. To avoid getting mired down in the complexities of deductions and tax code, I’ll simply use a quick and dirty approximation for an average:

Total_income = $5800 + 120% * Taxable_income

The $5800 is the standard deduction for a single filer in 2011, and the 120% comes from my quick-and-dirty assessment of the ratio of taxable to non-taxable income, with an assumption that this stays relatively constant overall income levels. There are many articles on the web providing average deduction levels for US taxpayers at different income levels. I invite you to find those and compare how my quick and dirty approximation fares, or to simply compare to your own tax returns. We are now in a position to compute Effective_tax_rate as:

Tax_liability / Total_income

To produce a nice graph comparing the two tax rates as a function of total income, I created a variable titled “Marginal vs. Effective” and defined it as a list:

[Marginal_tax_rate, Effective_tax_rate]

From its result view, I pressed the [XY] button and added Total_income as a comparison variable

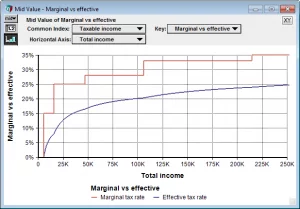

Leaving us with this final graph

Recalling the person on the radio who claimed a 28% tax rate but could barely make his rent each month, this graph makes it evident that he was confusing his marginal (the red line) with his effective (blue line) tax rate.

When you engage in the national debate about whether your taxes are too high, the effective tax rate is clearly the relevant number. However, when you are considering tax consequences when making a personal decision, the marginal tax rate is the pertinent value. Is the $20/hr pay for working an extra hour each week worth sacrificing your discretionary time? If your marginal rate is 25%, you should yourself if your discretionary time is worth $15/hr.

I have made my Analytica model (Marginal vs Effective Tax Rates.ana) available, and I welcome you to continue this exploration further using this model as a starting point. For example, you might explore how things change for people like Mitt Romney who derive most their income from capital gains and dividends. To make changes of your own, you will need either a licensed version of Analytica Professional, Enterprise or Optimizer, or the Analytica free trial.